To get the best possible outcome for your pub or club in this crisis, our Director Steve Gagel has put together the below summary of measures that both the Federal and State Governments have announced for business. He also provides a list of operational items you should consider.

$17.6B Round One Stimulus Package

$66B Round Two Stimulus Package (turnover up to $50M in 2019)

Click here for more information

2. QLD GOVERNMENT SUPPORT

Payroll tax relief - for more information, click here

Banking

Service Contracts - review all of these in place to see if there can be some relief or suspension until you get back into operation.

Poker Machines

5. ASSOCIATION WEBSITES

Finally, follow your association websites, they have plenty of information to guide you.

1. FEDERAL GOVERNMENT SUPPORT - click here for more information.

- Instant asset write off for new and second hand capital items under $150k (up from $30k) purchased between 12 March and 30 June 2020 (cars subject to luxury vehicle limit of $57,581).

- 50% asset write off for new only capital items (no cap for spend like above) 1 July 2020 – balance of 50% to be written off with standard rates.

- Wage subsidy of 50% of apprentice/trainee wages for up to 9 months between 1 January 2020 and 30 September 2020 capped at $21k per quarter for small business with under 20 full time employees.

- To Register, click here

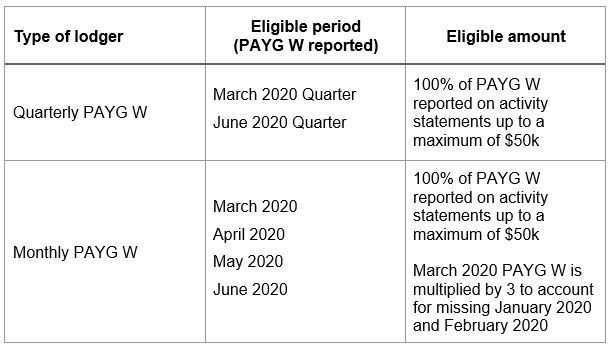

- $50,000 to small and medium businesses within weeks (via PAYG Withholding Tax Reduction)

- $50,000 to small and medium businesses in the new financial year (via PAYG Withholding Tax Reduction per above)

- Federal Government Guarantee half the value of new working capital bank loans by “eligible lenders” to small and medium companies (turnover up to $50M) to $250k repayable over 3 years with a 6 month repayment holiday (early April to September 2020).

- New Bankruptcy laws for directors – greater protection.

- Early access to Superannuation for unemployed - $10k pre 30 June 2020 and another $10k post 30 June 2020 – (you should seek financial advice prior to engaging in this activity – should be considered your last possible option).

2. QLD GOVERNMENT SUPPORT

- $250,000 interest free loans for 12 months to support business retain staff (cannot be used to refinance existing loans). To register, click here.

- $7,500 Equipment Purchase Grants for equipment costing up to $10,000

- $50,000 Project Grants to support market evaluation studies, market visits, staff training, new equipment. Applicants must co-invest 50% of total project costs – submissions due prior to 20 April.

Payroll tax relief - for more information, click here

- Payroll tax relief (still must lodge returns on time) - For more information, click here

- Under $6.5M in Australian Taxable Wages - To apply, click here

- Refund of your payroll tax for the two months

- Payroll tax holiday for 3 months

- Over $6.5M in Australian Taxable Wages

3. NSW GOVERNMENT SUPPORT

- 25% Payroll tax waiver for April to June 2020 Quarter (payroll up to $10M)

- New Payroll Tax Threshold of $1M applied from 1 July 2020 (one year prior to previous start)

- Waiver of various fees & charges to small business

- Click here for Prosperity's summary of the NSW and QLD Stimulus packages.

4. OPERATIONAL CONSIDERATIONS

Staff (Centrelink)

(a) Casual staff have largely been advised that they are no longer required due to the shutdown and employers have given separation certificates so that they can lodge with Centrelink asap for Job Seeker payment (previously known as Newstart). Will receive:

- an additional $550 per fortnight (on top of their existing payment) for the next 6 months. Also, significant reduction in the eligibility criteria for such payments.

- Tax-free once-off payment of $750 to recipients of social security, veteran and other income support. Paid from 31 March 2020.

- Additional tax-free payment of $750 to the same type of recipients (both new and those previously eligible) from 13 July 2020.

(b) Full/Part time staff are a little more difficult as you want a core team ready to go when you open again. I would approach in the following order:

- Identify key staff that you need to keep to get business up and running – discuss new terms with them, ie full pay or a mix of pay and use of leave accrued or leave without pay.

- Stand down balance of the team (cannot stand down those on leave) – give options of annual leave and long service leave at full or half pay.

- Staff that have been Stood Down can access the Job Seeker Payments (Only if all annual leave accruals are paid out)

- The big 4 banks are offering support to make sure you come out of this period. You should contact your bank manager and discuss relief options available to your business.

Property

- After you disinfect, clean and shutdown kitchens, cold rooms and bar fridges remember to keep aired ready for your return.

- Remove any cash (including ATM hoppers) and alcohol stock that may attract thieves.

- Turn off ice makers and disinfect and allow to air dry.

Stock

- Drain and clean beer lines.

- Consider return of stock to your suppliers or transfer to bottle shops if available.

- Perishable food to be frozen or discarded.

Insurance

- Call your insurance broker and discuss your changed situation and consider reduced cover for business continuation and stock wastage.

- Call your insurance broker once you get operational again to increase cover.

- Beware of “unoccupied properties” as they are targets of arson, vandalism and injury to invaders themselves. Insurers advise to have some level of activity or supervision in the premises whilst you are shut down or face increased premiums. Discuss with your security provider.

Service Contracts - review all of these in place to see if there can be some relief or suspension until you get back into operation.

- Electricity – discuss with your service provider.

- Hire of Plant and Equipment – non essential plant should be returned.

- Land Tax and Rates – discuss with your council/government about repayment strategy.

- Rent – discuss matter with your landlord, don’t leave for them to contact you.

- Lease Payments – contact your provider for relief available.

- Telephones – ensure you gather management telephones not in use and cancel plans.

Poker Machines

- Leave gaming machines on (do not turn off internal switch)

- Clear cash from machines

- Adopt normal end of month data entry and regulatory report creation

- Wait for Licensed Monitoring Officer to disable machines

5. ASSOCIATION WEBSITES

Our team of Hospitality industry experts are ready to help you through this difficult time. Please contact Steve Gagel for more information.