A Growing Market Share

The Australian home loan market is highly complex and can be overwhelming for borrowers who are turning in increasing numbers to mortgage brokers for help to navigate the market and find the best loan options.

According to a 2021 survey conducted by the Mortgage and Finance Association of Australia (MFAA), approximately 59% of Australians used a mortgage broker to obtain a home loan in the past 12 months. The survey also found that satisfaction levels among borrowers who used a mortgage broker were high, with 91% saying they were satisfied with the service they received.

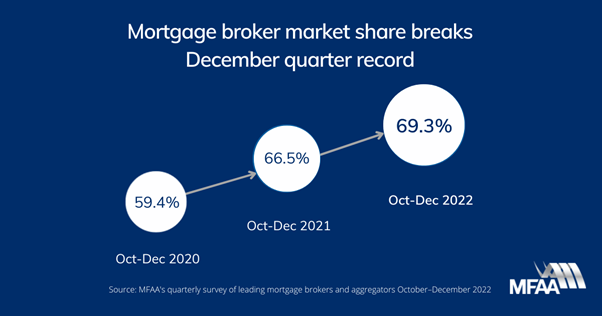

In another report released by research group Comparator, a CoreLogic business, mortgage brokers facilitated 69.3% of all new residential home loans between October and December 2022 or $89.58 billion.

The result is the highest mortgage broker market share for a December quarter on record. It represents a 2.8 percentage point increase compared to the 66.5% achieved in the same quarter in 2021 and a 9.9 percentage point increase on the 59.4% from the December 2020 quarter.

This data indicates that mortgage brokers offer a valuable service and play a significant role in the Australian home loan market, with borrowers preferring to use a broker to help them find the right loan for their needs. And all indicators are pointing to a continuation of this upward trend.

Why are Australians using mortgage brokers?

So why are so many Australians using a mortgage broker to help find their home loan and why should you?

1. Give you more loan options

Mortgage brokers provide borrowers with access to a wide range of lenders, which includes major banks, credit unions, and non-bank lenders. This gives them the ability to compare loan products from multiple lenders across the full breadth of the lending market and find the best loan option for each borrower.

With access to a variety of lenders, a mortgage broker can identify loans that better align with a borrower's specific goals. By comparing loan products from different lenders, they can find the best match for a borrower's needs.

Without a mortgage broker, borrowers may only have access to a limited number of lenders, which could cause them to miss out on loan products that could be a better fit for their needs.

2. Save you money

In addition to more tailored options, a mortgage broker's access to a wide range of lenders provides borrowers with better opportunities to save money. In fact, a mortgage broker can save you money in several ways:

- A mortgage broker can find you a loan with a lower interest rate than you would on your own. This can save you thousands of dollars over the life of your loan.

- A mortgage broker can find you a loan with better loan features that match your specific financial circumstances and goals. For example, a broker can find you a loan with flexible repayment options or the ability to make extra repayments without incurring fees, saving you money in the long run.

- With established relationships with lenders, a mortgage broker can negotiate on your behalf to secure a better deal. They can use their contacts and knowledge of the industry to advocate for you and help you get more favourable terms.

- A mortgage broker can compare lender rebates and promotional offers on your behalf, advise on eligibility, and recommend the best one (a little-known fact is that mortgage brokers frequently have access to special deals from lenders that are promoted via the broker channel only).

- A mortgage broker can provide ongoing support and advice throughout the life of your loan, helping you to manage your repayments and make changes as needed. This can help you avoid costly mistakes and ensure that you are always getting the best deal possible.

3. Save you time

The saying "time is money" means that time is a valuable resource, just like money. In the context of mortgages, the saying emphasizes the importance of saving time in the loan application process. By using a mortgage broker, you can streamline the process and save time by having a professional guide you through the various stages of the application process.

A mortgage broker can save you time in several ways:

- They can help you understand the complex mortgage application process and what documents are required, saving you time on research and paperwork.

- They can compare loan products from multiple lenders on your behalf, so you don't have to spend time researching and comparing loans yourself.

- They can help you understand the differences between various loan products, such as fixed versus variable interest rates, so you can make an informed decision without spending hours researching.

- They can liaise with lenders on your behalf, which can save you time on phone calls and emails.

- They can help you navigate the pre-approval process, which can be time-consuming, by gathering the necessary documentation and submitting the application on your behalf.

Overall, a mortgage broker can save you a significant amount of time by handling much of the legwork and paperwork involved in the mortgage application process, allowing you to focus on other aspects of your life.

4. Provide you with expert advice

Mortgage brokers are experts in the lending industry and can provide advice on lenders lending criteria, loan options, interest rates, and other important factors to help you make informed decisions. Most borrowers don’t have the knowledge and expertise to navigate the complex web of policies and products that brokers are well across.

A mortgage broker can provide you with expert advice on various aspects of the mortgage application process, including:

- Help you navigate the various loan options available to you and provide expert advice on which type of loan may be best suited for your financial goals.

- Provide guidance on interest rates, including whether to choose a fixed or variable rate, and help you understand the impact of interest rates on your mortgage repayments.

- Help you understand the fees and charges associated with different loan products, including upfront fees, ongoing fees, and exit fees.

- Provide insight into lender policies and requirements, such as credit score requirements, income verification, and documentation requirements.

- Help you navigate the pre-approval process, including the documentation required and the timeframe for obtaining pre-approval.

- Help you understand the terms and conditions of your loan and explain any legal requirements.

Overall, a mortgage broker can provide you with expert advice on a wide range of topics related to the mortgage application process, helping you make informed decisions and saving you time and money in the long run.

5. No cost to you

Using a mortgage broker is a smart choice for borrowers looking to secure a loan. In most cases, there is no direct cost to the client as the broker receives a commission from the lender upon loan settlement. In most scenarios, this allows borrowers to access the expertise of a mortgage broker without any additional financial burden. It is a no brainer really, as overall, the expertise of a mortgage broker can help you navigate the complex world of lending and make informed decisions about your mortgage. They can save you time, money, and stress by providing expert advice, negotiating on your behalf, and providing ongoing support and guidance throughout the life of your loan, typically at no cost to you!

Contact us

If you're considering obtaining a loan to buy a house, an investment, a car, or simply want to refinance for a better deal and want to make the process as smooth and stress-free as possible, consider working with the experienced lending team at Prosperity Advisers. We can offer you a range of mortgage options and help you find the one that best fits your needs and financial situation.

Our Senior Lending Advisers have access to a panel of over 70 lenders and 100s of products across residential finance, commercial finance, business finance and asset finance.

Contact our National Lending Manager Chris Lamb on 1300 795 515 or email clamb@prosperity.com.au.